If you take apart almost any modern device, like your phone, a laptop, the motor inside an EV, or your vacuum cleaner, you’ll find a common set of materials that are quietly powering our technologies. These are rare earth metals, a group of 17 elements that, despite their name, aren’t truly rare.

Rare earth minerals have scarce supply chains, which makes them central to geopolitics, manufacturing, and the clean-energy transition. Understanding them is no longer a niche scientific interest; it has become essential knowledge for anyone working in electronics, automotive, renewable energy, or advanced manufacturing.

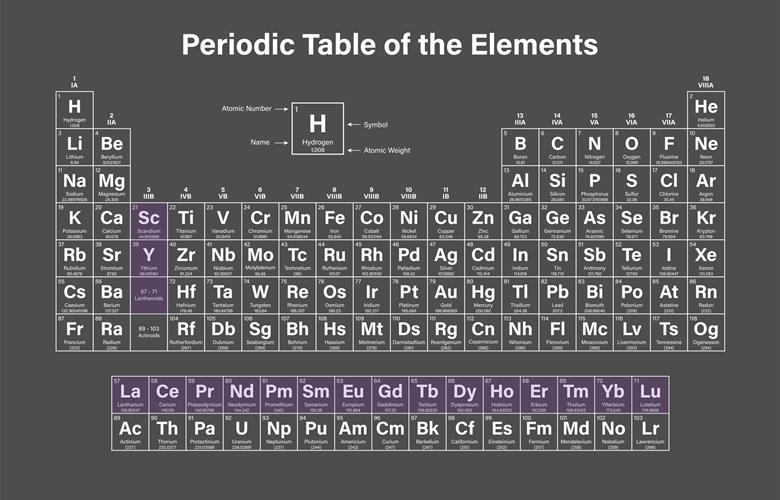

Rare earth metals are a set of elements that show very unusual physical behaviors, especially in how they respond to magnetism, heat, and light. Rare earth minerals are a family of 17 metals: 15 lanthanides on the periodic table, along with scandium, and yttrium.

They generate magnetic forces far stronger than those we get from iron. They react to light and heat in ways that other metals cannot replicate. They help stabilize alloys that can function at temperatures where standard materials would deform.

Despite the name, rare earth minerals are not geologically rare. They appear widely across the Earth’s crust, often more plentiful than metals like copper or tin. What makes them complicated is their low concentration and the difficulty in separating them.

The process of separating them from surrounding minerals requires advanced chemistry, high energy input, and water-intensive finishing steps. That difficulty is what shapes the entire rare earth market.

Rare earth metals are used wherever a device requires strong magnets, sharp optical output, or materials that retain their shape under high temperatures. They appear in compact motors, generators, and sensors because they create magnetic fields that are far stronger than those of conventional metals. They also make it possible to produce bright screens, stable lasers, and precise imaging systems by controlling how light is absorbed or emitted.

In metalworking, small amounts of rare earths are added to alloys to keep them stable at temperatures where most materials begin to warp or lose efficiency. They are found in catalysts, polishing powders, batteries, and electronic components to enhance performance.

Rare earth minerals are spread widely across the planet, but they rarely appear in concentrated layers near the surface. Geologists often find them in hard-to-reach deposits formed by ancient volcanic systems, continental rifts, or weathered igneous rocks.

That means while some countries have rare earths, only a handful have deposits that are both rich enough and accessible enough to support commercial extraction.

Mining isn’t the only issue; the refining step is extremely environmentally sensitive. This is why many countries have deposits but limited functional output. Extracting rare earth minerals without contaminating soil and groundwater is a real challenge.

Unlike iron ore or coal, rare earth minerals are bound tightly within other rocks. To mine rare earth minerals, engineers need to navigate the radioactive byproducts in some deposits. They also need to handle the waste and go through multi-stage chemical treatments.

Even with better environmental rules, mining still uses a lot of energy and needs careful management. The industry is slowly moving toward cleaner methods, but the complicated process of separating materials remains a big challenge.

Rare earth metals are rarely used in bulk, unlike steel or copper. But the small amounts that go into modern equipment actually make the technology work efficiently.

Consumer Electronics

Everything from phone screens to computer drives relies on rare earth chemistry in some form. According to the United States Geological Survey (USGS), europium and terbium are key phosphor elements used in liquid crystal displays, fluorescent lighting, and LED backlighting, contributing to the red and green emission that makes displays bright and vivid.

For sound and motion, neodymium is the anchor metal for high-strength permanent magnets used in hard disk drives, speakers, and small electric motors. These magnets stay powerful even when miniaturized, which is why smartphones, laptops, and wearables use them instead of heavier electromagnetic coils.

Even many cameras, including those in phones, lean on lanthanum-based optical glass, which improves clarity and reduces distortion.

Renewable Energy Systems

Electric vehicles and wind turbines depend heavily on rare earth permanent magnets. The USGS notes that neodymium-iron-boron (NdFeB) magnets, often modified with dysprosium or praseodymium, are the most powerful commercial magnets available. They allow motors and generators to stay efficient at high temperatures and under continuous load.

Modern Manufacturing

Manufacturing sectors often use rare earths in combination with steel, copper, aluminum, and advanced alloys to stabilize performance.

Cerium, for example, is widely used in catalysts and metal alloys, helping stabilize oxidation and control grain behavior. Lanthanum appears in petroleum refining catalysts and optical-grade glass.

In high-temperature or precision equipment, samarium-based magnets and praseodymium-enhanced alloys offer the thermal stability and magnetic strength required for industrial motors, actuators, and robotic assemblies.

These materials don’t replace bulk metals, they upgrade them. This helps motors to run smoother, alloys to tolerate higher temperatures, and tools to function with greater accuracy.

Defense and Aerospace Sectors

Across defense and aerospace technologies, rare earth metals are found wherever performance under heat, vibration, or magnetic load is crucial.

The USGS confirms the widespread use of neodymium, samarium, dysprosium, holmium, and erbium in systems ranging from lasers and optical components to high-temperature magnets, guidance systems, and nuclear shielding materials.

Healthcare

Healthcare makes specialized use of rare earth elements:

While geology determines where rare earth minerals are present in the ground, geopolitics determines who gets to turn them into economic power.

The split between the two began decades before electric vehicles or wind turbines made these rare earth metals strategically important. Throughout the 1980s and 1990s, China expanded its mining, refining, and chemical separation operations, while other countries tightened environmental rules and stepped back from solvent extraction. By the time rare earths became integral to modern technology, the global manufacturing chain was already anchored to China.

According to Fortune Business Insights, Asia Pacific held roughly 86% of the global rare earth elements market in 2023, mainly driven by China’s dominance in both mining and separation. That dominance is not only geological; it’s also infrastructural.

China built capacity early, scaled it aggressively, and paired mining with downstream magnet manufacturing. When compared with the rest of the world, fewer countries have actually invested as much as China across the entire value chain. Which means most of the world’s high-performance magnets, catalysts, polishing compounds, and battery materials still rely on Chinese output.

The global rare earth elements market is projected to climb to USD 8.14 billion by 2032 with a 10.2% CAGR. And the U.S. share is expected to reach around USD 394.39 million by 2032, as automakers and electronics firms push for local supply. The US has restarted its supply chain, starting with the Mountain Pass operations in 2024. Fort Worth, Texas, magnet plant and Utah plants have also begun producing mixed rare earth carbonates.

Even so, nearly 70% of actively mined rare earth minerals come out of the Bayan Obo district in Inner Mongolia, an ore body that has anchored China’s rise in this sector for decades. As we move into the market dominance of processing, China's share sharpens. The International Energy Agency’s 2025 outlook notes that for 19 of 20 strategic minerals, China is the leading refiner, averaging around 70% of global refining capacity, including rare earths.

China has been stockpiling refined rare earth oxides and magnet alloys, which has thrown the global market out of balance. By keeping these materials in reserve, China can control its own prices and support its manufacturers when demand rises. This gives China power over the global supply of rare earth minerals, while other countries depend on unstable spot markets and long import times.

This is more than a new geopolitical tactic. It’s an extension of the strategy that began when China flooded the market in the late 1990s and early 2000s, pushing mines elsewhere, most notably the Mountain Pass in the US, out of commercial viability.

Having rare earth stockpiles also helps China to buffer domestic industries from global volatility. When prices rise globally, Chinese firms experience less shock. When prices fall, the country’s stored volumes help prevent instability. The rest of the world, in contrast, must navigate volatile markets, slow refining build-outs, and limited alternative suppliers.

When a country controls most of the rare earth midstream processing and also holds reserves, it becomes the anchor of global pricing and availability.

Manufacturing rare earth materials has always been a complicated process. The chemistry is quite challenging, and handling waste requires careful management. However, there are changes on the horizon regarding how these processes are executed. New advancements are emerging that are transforming the journey of these materials from raw concentrate to finished components.

A good example of the chemistry shift comes from Ames National Laboratory. Their team developed a non-toxic processing route that replaces aggressive acids with a sodium rare-earth fluoride method. This helps cut down the number of steps, limit hazardous waste, and produce high-purity material without running the process like a hazardous-materials facility. Since refining is where most of the environmental pressure sits, if the chemistry becomes cleaner, the entire downstream chain in rare earth manufacturing could benefit from steadier material quality.

Automation is also changing the picture. Rare earth refining relies on tight control of pH, temperature, and separation conditions, and older plants often struggled to keep these settings steady. Newer facilities use sensors and machine-learning models to make those adjustments automatically, which keeps impurities down and yields more predictable results.

Many companies have begun recycling discarded materials to extract rare earth metals. Many discarded motors, drives, and electronic components still contain usable rare earth metals like neodymium, praseodymium, dysprosium, and samarium.

While the technologies exist to recover these metals, the logistics of collecting and processing scattered consumer electronics require highly precise and careful operations. If these methods scale, they can ease some of the pressure on mined supply, especially for magnet-grade material.